Explore our markets

Industrial Materials

Industrial materials are in demand for every human endeavor. With a large market size and expected growth, investing in the field gives us an opportunity to shape the future while earning good returns on our investments. Our dedication to the industrial materials remains unchanged despite its volatile price history and constant changes in regulatory policies.

OUR PRIMARY AREAS OF INVESTMENT INCLUDE:

- Exploration and Production

- Marketing and Distribution

Oilfield & Sea Support Services - Innovative Energy Technologies

- Power Generation and Transmission

- Alternative Energy and Renewables

- Mining and Metals

Financial Services

Financial services attracts the largest proportion of impact investment and it is an important component of a healthy and well diversified portfolio. Given the growing interrelationship between financial services and technology, we have taken a multidisciplinary approach to this sector by utilizing investment strategies that build partnerships with tech and financial services companies.

OUR PRIMARY AREAS OF INVESTMENT INCLUDE:

- Private Banking

- Fiat Exchanges

- Blockchain Technology

- Financial Technology

- Asset/Wealth Management

- Payment Processing Companies

- Specialty and Consumer Finance

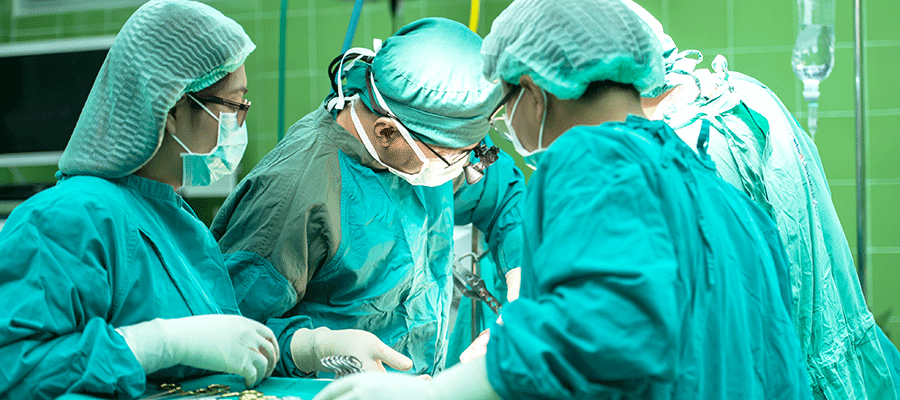

Healthcare

OUR PRIMARY AREAS OF INVESTMENT INCLUDE:

- Medical Insurance

- Medical Robotics

- Data management

- Laboratory Science

- Distance Medication

- Medical Infrastructure & Facility

- Healthcare Instrumentation and Automation

Agriculture

OUR PRIMARY AREAS OF INVESTMENT INCLUDE:

- Crop science

- Fertiliser production

- agricultural economics

- agricultural farmland

- Supply chain and logistics

- Engineering and precision technology

- Raw materials, Livestock & food production

What we do

We create value

Our philosophy

Our approach

Our strategy

Who we are

Vision

Mission

Core Value

Boldness

We go the extra mile for our clients. We are ever innovative and go beyond delivering what works, to discovering new insights that will maximize our clients wealth potential.

Accountability

We adhere to a strict, well informed and disciplined investment approach, safeguarding our clients investments and earning their trust day by day.

Stewardship

We conduct our activities and business practices with openness and full disclosure keeping our investors up to date and in the know.

Integrity

We take pride in upholding the trust our clients place on us adhering to the highest standards of integrity and professionalism.

Commitment

Because we are committed to our clients' success, we constantly build an environment that inspires creativity and values teamwork while rewarding personal contribution.

Service

We strive to exceed our clients’ expectations and execute mandates speedily with regular up-to-date reports on the status of their transactions.

Leadership

Meet our professionals

Takuya Akaza

Chairman & CEO

Takuya is a qualified finance professional with years of experience in investment banking, mergers and acquisitions. He leads and executes SKAI’s overall strategy which seeks to optimize current investment strategies and digitize certain business processes and company operations.

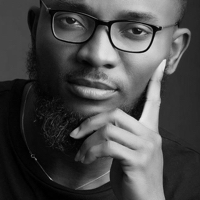

Oluwasegun Ogunderu

Chief Operating Officer

Oluwasegun brings a strong background in wealth management and acquisitions to his role. With years of experience in successful portfolio management, He seeks to create a collaborative and inclusive environment, while ensuring SKAI maintains a high level of service excellence and professionalism.

Chuba Okanume

Chief Investment Officer

Chuba serves SKAI Partners as the Chief Investment Officer, representing all of its diverse investment capabilities. With a strong background in infrastructure, financial experience and commodity trading, He oversees the company’s investment analysis, strategy, execution and performance monitoring.

Jui Ping Lu

Head, Trade Finance

With years of experience in investment banking, venture capital and equity across different continents, Jui holds the position of head trade finance to achieve the overall goal of SKAI Partners.

Contact Us

Should you have any inquiries or questions, please feel free to contact us. Thank you.

502 Prosperous Building

48-52 Des Voeux Road

Central, Hong Kong

SKAI is a trademark of SKAI Partners Limited in Hong Kong and throughout the world. ©2023 SKAI. The information provided herein is not directed at any investor or category of investors and is provided solely as general information about our products and services and to otherwise provide general investment education. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as SKAI (and its affiliates) is not undertaking to provide impartial investment advice, act as an impartial adviser, or give advice in a fiduciary capacity with respect to the materials presented herein. Capital under management or assets under management refers to the commitments under management for all private equity funds managed by SKAI and assets under management for all credit funds and separately managed accounts managed by SKAI and its affiliates. By using this website you agree to the terms and conditions. SKAI strives to provide individuals with disabilities equal access to our services, including through an accessible website. If you have questions, comments, or encounter any difficulty using our site, please email us at admin@skaipartners.com